Running a successful business is no easy feat. But while you might assume that you’ll need an endless stream of new customers to reach the next level, your success might actually hinge on your ability to retain and grow your existing customers.

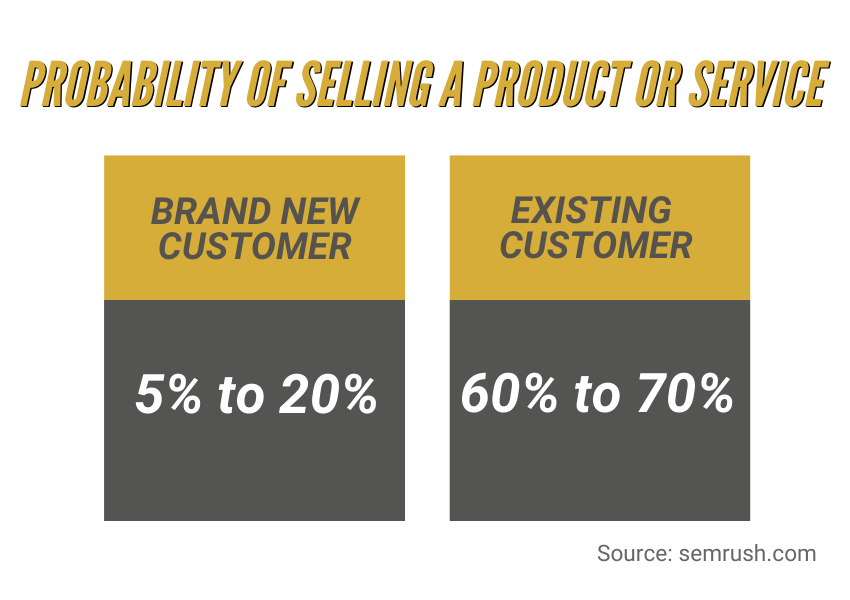

That’s because, according to SEMRush data, it makes far more financial sense to keep your current customers and help them grow over time. Their statistics indicate that the probability of selling a product or service to a brand-new customer hovers around 5% to 20%. But when selling to an existing customer, that probability skyrockets to somewhere between 60% and 70%.

In other words, client retention matters. But if you haven’t cracked the code to keep customers around, you might feel like you’re fighting an uphill battle.

If this scenario sounds familiar, you may feel like you’ve tried everything to reduce customer churn. But any effort you make in this area needs to be supported by solid data. Without that crucial information, you can’t develop an effective customer retention strategy.

Enter: Customer Lifetime Value

This metric can act as the starting point for your sales and marketing efforts – and it’s one you can’t afford to skip over. Let’s take a closer look at customer lifetime value, how to calculate it, why it matters for customer retention, and how to improve these metrics to amplify the success of your business.

What is Customer Lifetime Value?

First, let’s start by defining customer lifetime value. Also known as lifetime customer value (or LCV), this is an estimation of how much a customer is likely to spend – or how much revenue you can expect them to generate – over the course of their relationship with you.

Customer lifetime value is different from customer acquisition cost (CAC). CAC reveals how much your business will have to spend in order to bring on a new customer within a given time period. LCV, on the other hand, shows you what happens once they start working with you. LCV can show you, among other things, whether your CAC is too high for the payoff you’re currently getting.

As such, LCV can also reveal where you should be placing your efforts. It can highlight whether you’re targeting the right kinds of customers, or whether you’re investing too much time into clients who aren’t spending as much money as you need them to be.

It can also help you visualize the domino effect of high customer churn rates; while you might think it’s easy enough to replace existing customers when they leave, LCV can allow you to see the mistakes you’re making during the sales or customer service processes that could be derailing your current strategy.

Most of all, LCV can be a great indicator of customer loyalty. Customer loyalty can be hard to come by in the digital age. But since the average loyal customer spends 67% more during their 31st to 36th months with a brand than they do during the first six months of their relationship, it’s crucial for businesses to keep as many of their existing customers around for as long as possible. By calculating LCV, you can gain additional insight and make more informed decisions to improve customer loyalty within your organization.

How Can You Calculate LCV?

Now that you understand why LCV matters, you might be wondering how to figure out this number for yourself.

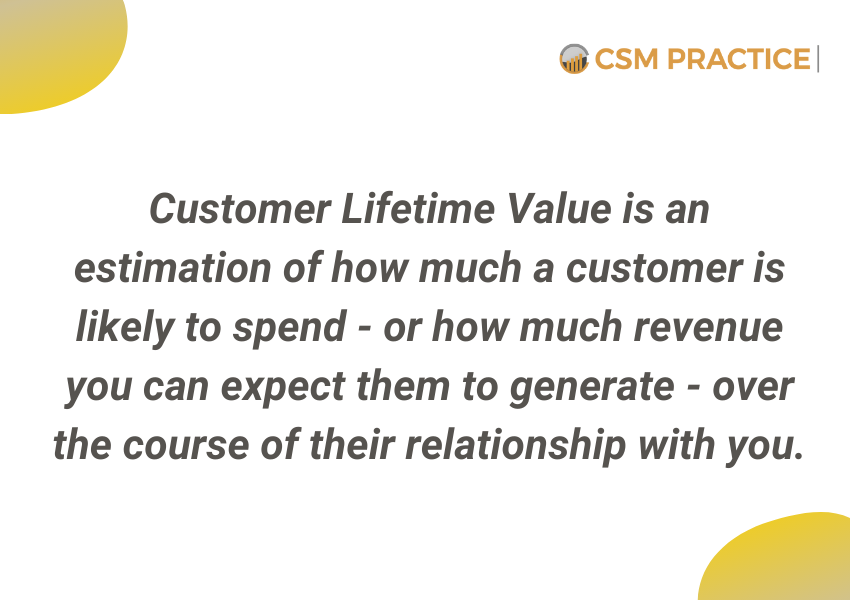

SEMRush tells us that while over three-quarters of businesses agree that customer lifetime value is important to their organization, only 42% of companies know how to accurately measure LCV.

If you’ve never calculated your lifetime customer value, you certainly aren’t alone. For those who want to do their calculations the old-fashioned way, start by dividing your annual revenue by the number of purchases made during that year. Then, find your average purchase frequency by dividing the number of purchases made by the number of customers you have in that year. Multiply these two aforementioned figures to get your customer value. Finally, divide that customer value number by the average customer lifespan. This will give you your lifetime customer value.

However, you don’t even have to go through all that trouble. You can use a free LCV tool to easily and automatically calculate your lifetime customer value. You’ll just need to plug in a few values specific to your business, like your churn rate, average customer lifespan, median invoice, monthly sales, and marketing costs, and an average number of new customers each month.

Once you calculate this number, you’ll be able to see where you stand. Keep in mind that long-term customers will usually have a higher lifetime value than new customers, since established customers are likely to spend more over time. But if you’re seeing low LCV rates even with more loyal customers or your churn rate is through the roof, that’s a good sign that something needs to change to improve your revenue and overall retention.

How Are LCV and Client Retention Related?

Essentially, LCV and customer retention are both outcomes of a positive and profitable business relationship. The more loyal a customer is to your business, the higher their LCV will probably be. And if you take steps to improve the lifetime value of your customers, retention will probably increase, as well.

In other words: if you struggle with client retention, your LCV will likely need some TLC, too. If your LCV is lower than you’d like it to be, you may also find it difficult to keep customers around. This isn’t a cause-and-effect relationship, but the two values do correlate in most cases.

Therefore, you’ll want to focus on LCV if customer retention is a top priority for your company. Without the hard data that LCV calculations provide, you’ll have a much more difficult time figuring out what changes to be made in order to increase profits and customer satisfaction.

How Can Customer Retention and Lifetime Value Be Improved?

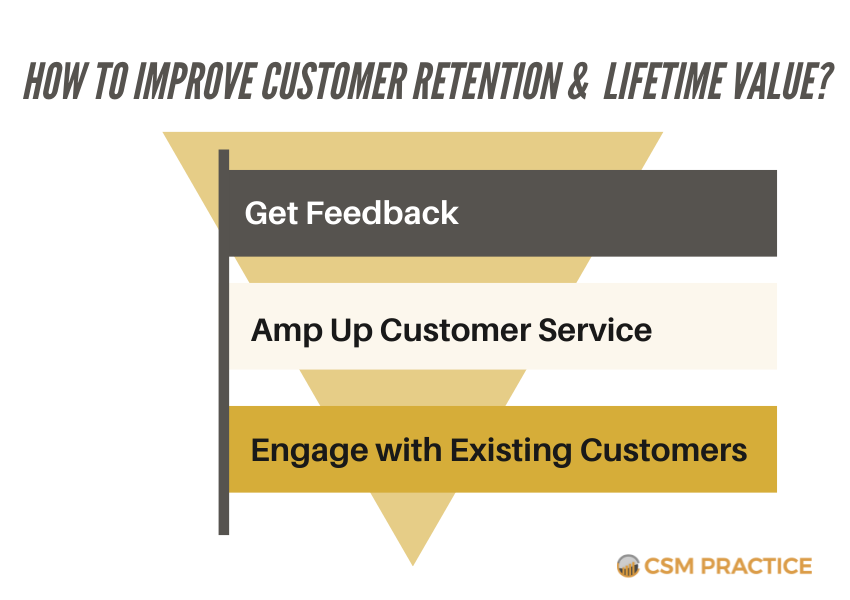

Say you’ve calculated your LCV and have found it’s lower than what’s needed to grow your business. Don’t panic. Instead, start implementing some of the following strategies to improve both LCV and customer retention.

- Get Feedback (and Give Customers Credit): It may sound extraordinarily simple, but one of the most effective ways to keep a customer happy is to “get them in the room.” Clients will often forgive a mistake if they know you’re taking their feedback seriously and are making every effort to improve. Find out why your customers are leaving or how likely they are to recommend you to others with a survey or questionnaire. Use the feedback you receive to address existing issues – and publicly give them credit for these changes once you implement them!

- Amp Up Customer Service: Although customer loyalty is driven by how much a customer loves a product, the level of service they receive can make or break their experience. Make sure that you’re accessible whenever customers need you through a variety of channels (like social media, your website chatbots and contact form, email, phone, and more). Give every customer the gold-star treatment they deserve by reducing delays in problem-solving and removing barriers to exemplary service. Above all else, show them how much you care about their experience and are committed to making the situation right for them. This will set you apart from the competition and let your customers know that they won’t find this type of hands-on service anywhere else.

- Engage With Existing Customers: Instead of focusing all your efforts on marketing to new leads, consider making your long-term customers a priority with marketing and sales. Even when there aren’t any problems, you’ll want to continue building your relationship with these clients and taking every opportunity to inform them of new developments, special offers, and personalized solutions. At the very least, you’ll remind them that they matter to you. And if you happen to strike a chord with them, you’ll have a chance to sell even more products and services that can improve their lives. We know that customer retention matters, so don’t be afraid to show your clients that you’re thinking of them.

It’s clear that having a clearer understanding of LCV can allow you to improve client retention rates, as well as maximize profitability and boost brand perception. If you’ve been struggling to retain your customers, take a closer look at your LCV and implement these suggestions to improve these relationships in the long term.