Customer churn is a vital metric for the success of any SaaS company and its customer success team. It is the rate at which customers cease their relationship with a business over a specified period. Churn directly affects the sustainability and growth of SaaS businesses, as small monthly increases in churn percentage can compound over time and drastically reduce revenue.

In the US alone, businesses lose about $83 billion in revenue every year to churn and abandoned purchases. At the same time, a 5% increase in customer retention rates can increase profits by up to 95%. Therefore, SaaS companies must focus on understanding and reducing churn through analysis.

Why Do Customers Churn?

Understanding the numerous reasons for customer churn enables SaaS businesses to conduct better churn analysis, mitigate churn, increase customer retention, and consequently increase revenue. Customers may churn for many reasons, including:

Product Misfit

These are the most popular type of churn, and it may be due to missing functionalities that are crucial to the customer’s business goals, poor customer fit, poor onboarding, and failure to achieve business outcomes with the product.

Better Competitor Offering

Your customers may churn to your competitor to take advantage of better price points and more optimized packages.

Inadequate Customer Engagement

Companies that neglect customer relationships lose their customers because the customers easily forget the importance of their service, or they may have unresolved payment issues.

Customer Satisfaction

Satisfied customers can also churn if they are unaware of additional product offerings or business outcomes that can benefit them. This type of churn, although mostly unnoticed, still affects your revenue and should be included in your churn analysis considerations.

What is Churn Analysis?

The actual reasons why customers leave your business vary, and proper churn analysis is how you can uncover those reasons. Churn analysis measures the customer attrition rate in your business to discover which customers are likely to churn. Churn analysis provides valuable insights into why former customers churned and why existing customers may churn.

Why Churn Analysis Matters?

Without proper churn-renewal analysis, companies are left to guess why customers left or why they renewed. Some companies also immediately attempt to replace lost customers with new ones by spending additional funds on marketing campaigns. However, it costs 5 times more to acquire a new customer than it does to maintain current ones. The probability of selling to current paying customers is 60-70%, but only 5-20% for new customers.

The actual cost of a lost customer goes beyond the loss of their lifetime value and revenue; the marketing cost to acquire the customer has also been lost. In some cases, the customer acquisition cost (CAC) has not been realized at the time they churned.

Churn analysis helps SaaS businesses retain existing customers and protect recurring revenue by:

- Analyzing the negative customer experience

- Identifying data-backed reasons for churn

- Predicting at-risk customers

- Engaging with customers to strengthen the relationship

- Identifying competitive threats

- Reducing marketing costs

- Revealing opportunities for cross-sells and upsells

Proactive Data-Driven Churn Analysis

I spoke with Paul Piazza, the VP of customer success at Reciprocity, about his strategy for customer churn analysis. He detailed an approach he aptly calls the “Product Top 10”, which reveals the influence of certain changes on customer retention rates.

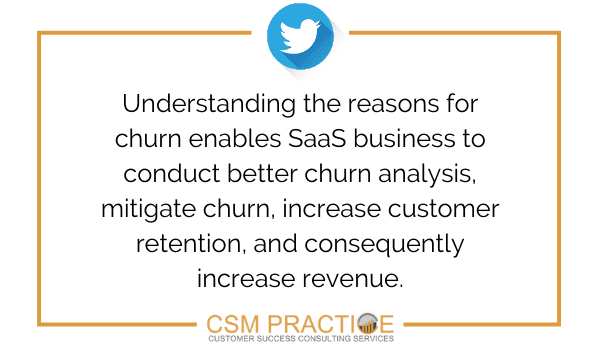

Step 1: Identify the Top 10 Reasons for Churn

The CSMs discover the top 10 reasons for churn based on their experience and observed trends in a whiteboarding session.

Step 2: Map the Top 10 Reasons with Accounts

Each CSM identifies at-risk accounts for each of the top ten reasons. This represents the risk that can be mitigated. One customer account may be associated with multiple churn reasons, and input from each CSM is collated into a single spreadsheet.

Step 3: Connect At-Risk Accounts with Revenue

Using a CS tool, calculate the dollar amount in revenue of each at-risk customer and aggregate it. Calculate how much has been lost in revenue by correlating the churn reasons with churned accounts. Support your results with data and trends like the number of support tickets opened for particular reasons that led to churn. In cases where data is insufficient or unorganized, this process can be completed using revenue figures only.

Step 4: Collaborate and Implement Changes

Fix churn reasons by collaborating with other teams using your data-backed analysis. If a product feature or functionality is among the top 10 reasons, present the report of at-risk revenue to the product team and encourage them to make appropriate changes.

This analysis may be conducted quarterly, and it can be used to proactively mitigate a significant amount of risk.

Feedback-Driven Churn Analysis

In a complex B2B organization, survey response rates and poor data quality can distort the reasons associated with renewal and churn. More actionable data can be obtained from post-decision interviews with customers that renewed as well as those that churned. An unbiased third party is best suited for this interview so customers can express their full feedback without holding back.

At CSM Practice, we turn in-depth interviews with your best existing customers and churned ones into actionable feedback that can be used to drive effective strategies for mitigating churn, increasing renewals, and expansion.

Summary

Instead of making assumptions as to why customers leave, customer churn analysis helps to quantify the reasons for churn, and it reveals crucial changes that can instantly lead to increased customer retention. Churn analysis backed with relevant data and useful feedback makes for easier collaboration, garnering executive support, and course correction to achieve your business goals.

April 2, 2020

great article! I really learned a lot. will subscribe to your mailing list from now on. Thanks!

January 16, 2021

I got this web site from my pal who informed me about this web page and now this time I am browsing this site and reading very informative articles at this time.|

January 16, 2021

Thank you for your appreciation. We acknowledge your ideas and opinions. Please sign up for our newsletter. Click Here